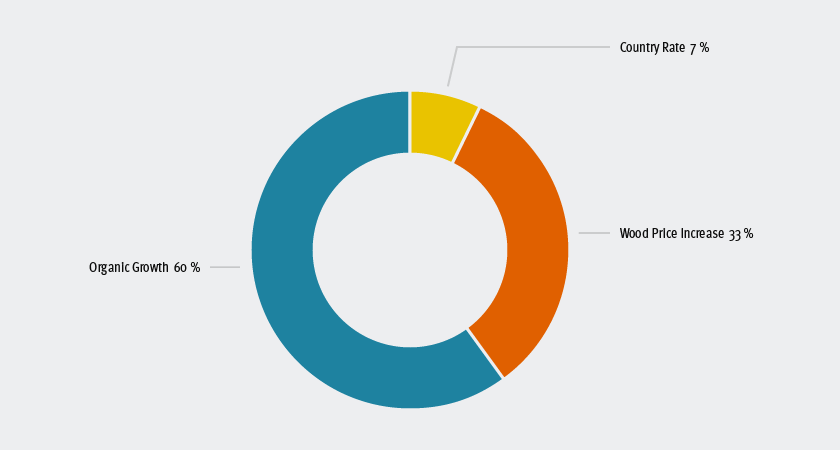

The return on forestry investments basically consists of two elements:

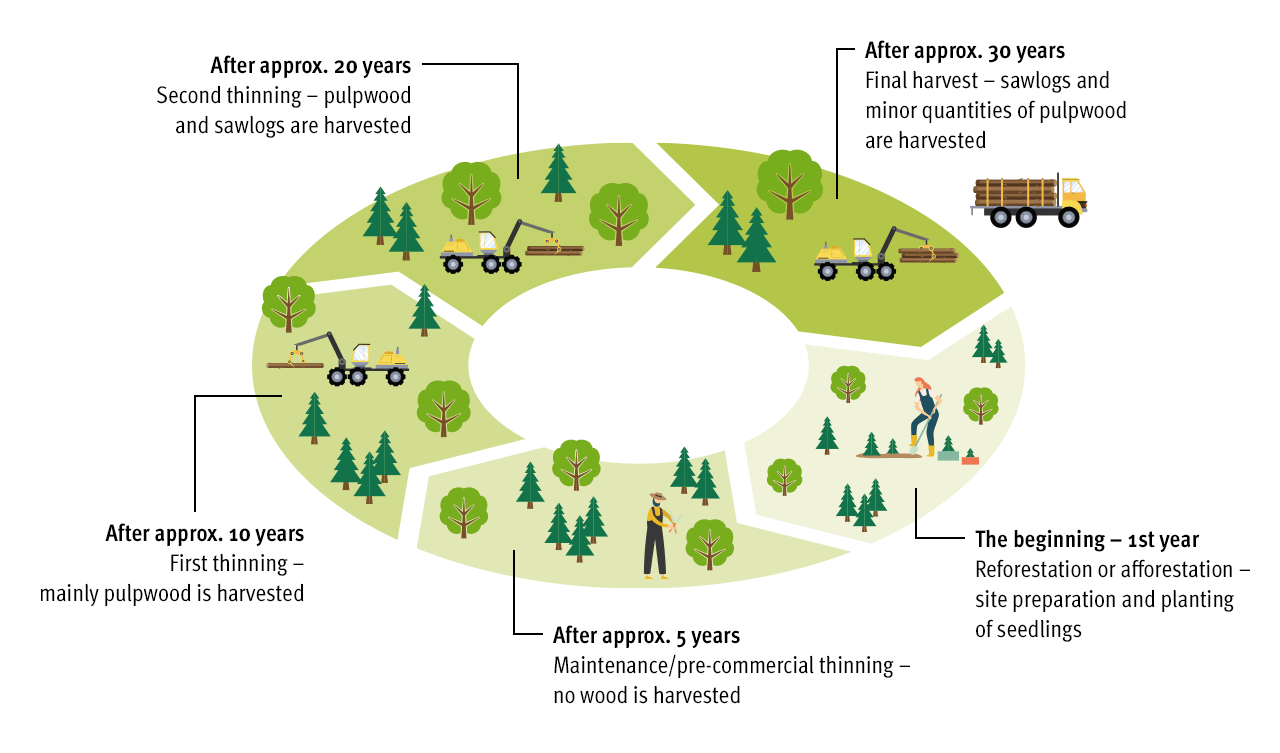

- The annual cash flow generated by harvesting activities and the sale of timber, and

- A return on value change driven by growth (increased volume)

- and the price of timber per assortment (e.g., saw timber, paper timber).

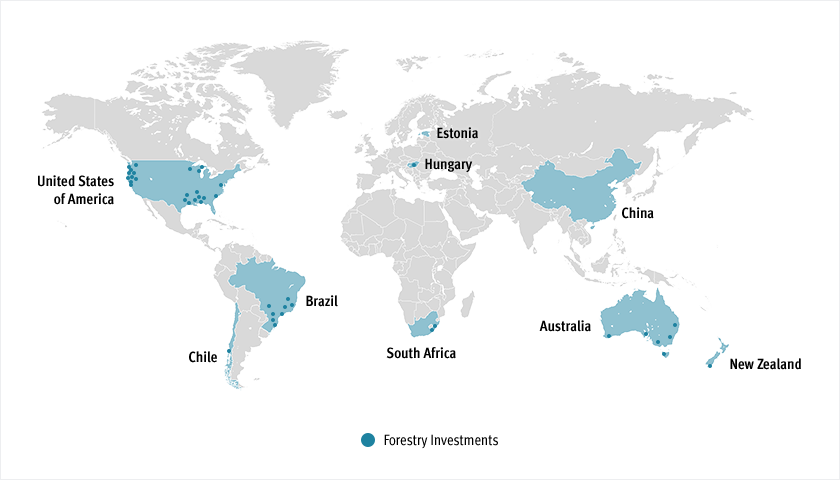

Returns depend on the respective investment regions, as local specifics such as the dominant tree species and their growth behavior, supply and demand on local timber markets and thus the level of timber prices, or cost structures also influence returns. The only available index for forest investments is the National Council of Real Estate Investment Fiduciaries (NCREIF) Timberland Property Index, which tracks the returns of professionally managed forest areas in the US. Since 2001, this index has shown an average annual return (IRR) of 6.5% at the forest area level (i.e., before any asset management fees). Based on our experience, IRR returns for new investments in the US (after local costs and taxes and before fees) are around 6.5%, while in Oceania, returns can be up to 1% higher.