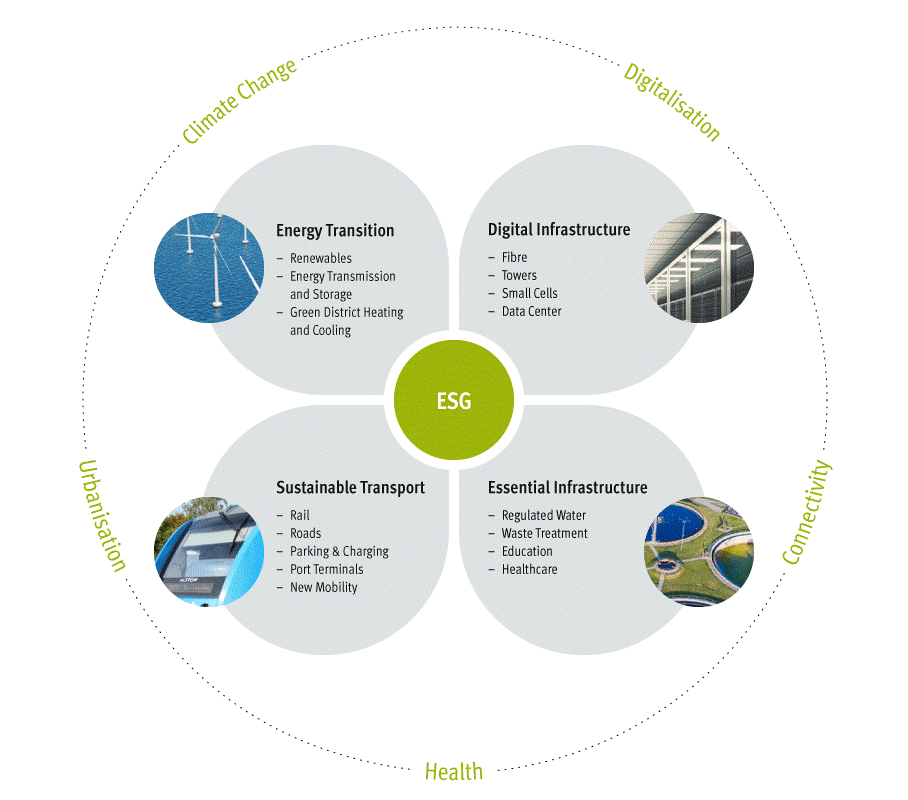

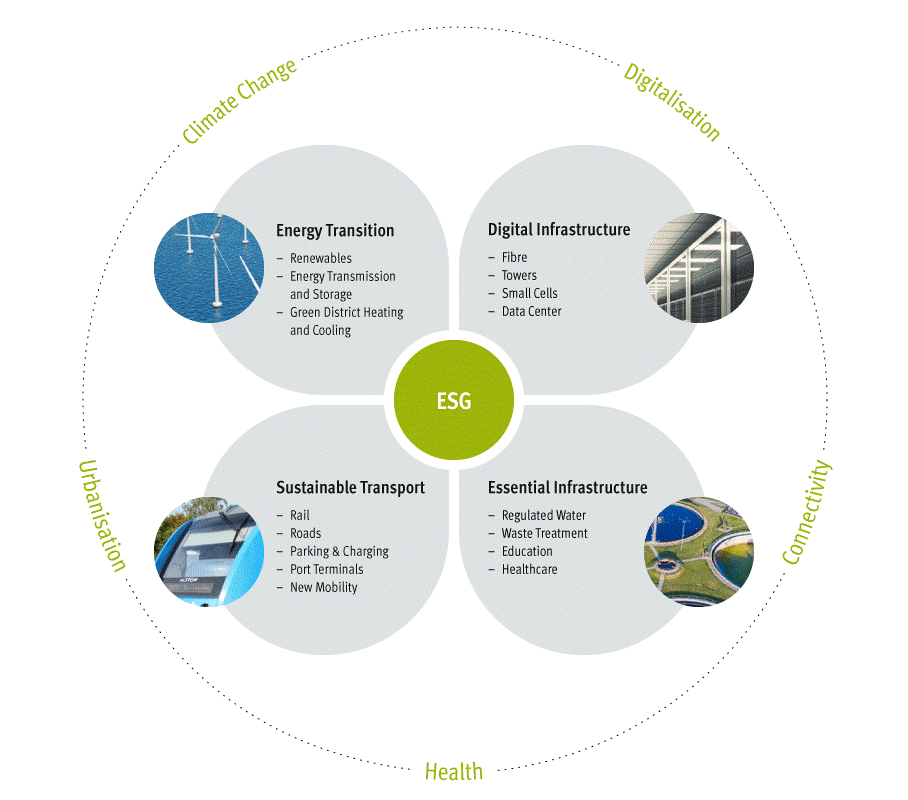

Our investment focus underlines the global megatrends of (i) Energy Transition, (ii) sustainable transport, (iii) digital and (iv) essential infrastructure, with the sustainability (ESG) of the chosen business models being of central importance:

Diversified infrastructure portfolio with an attractive risk/return profile

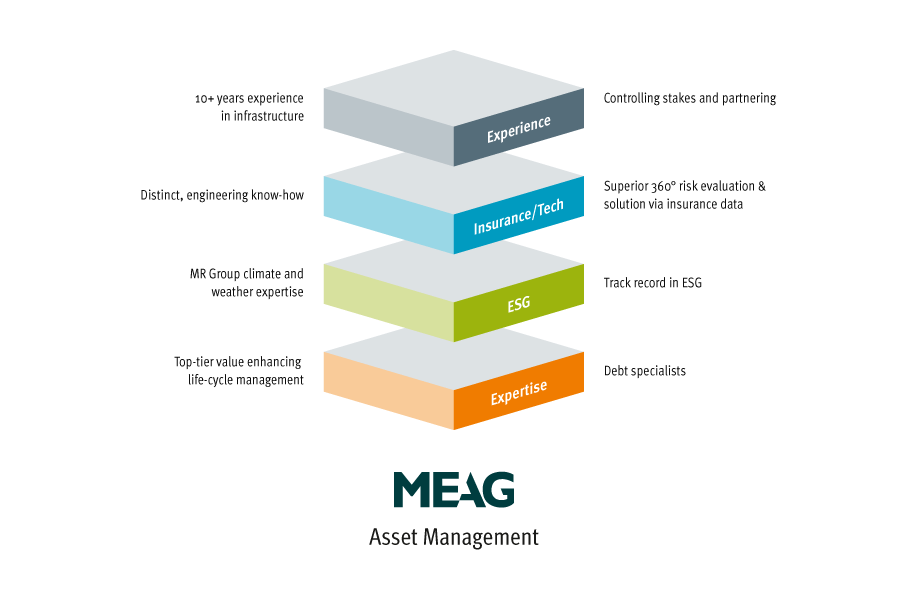

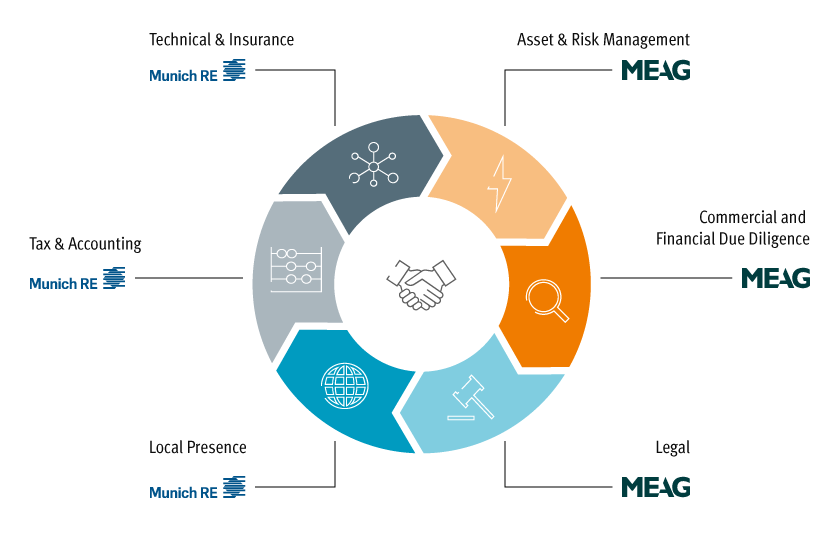

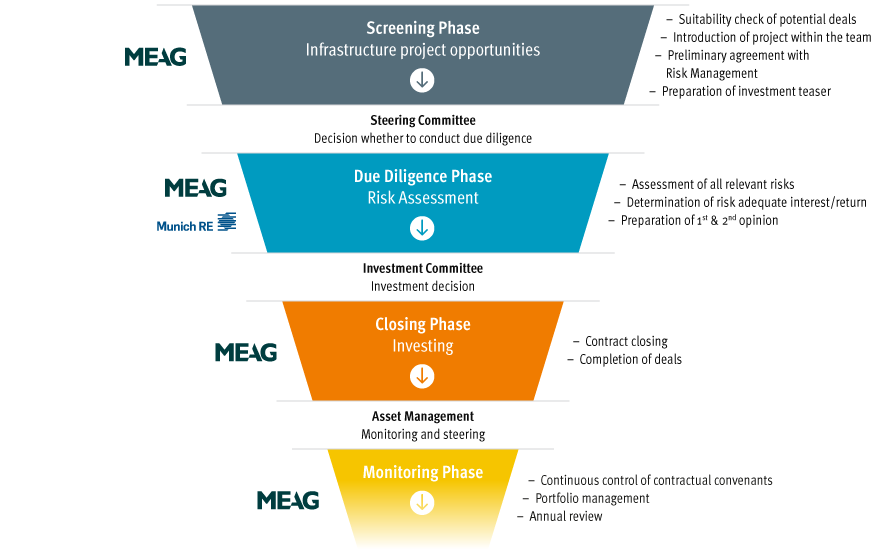

In the Infrastructure Equity asset class, we invest in infrastructure companies and projects with a "core" or "core+" risk profile. In doing so we focus on both brownfield and greenfield assets and consider both minority and majority stakes. Our goal is to build a diversified infrastructure portfolio with an attractive risk-return profile, with an investment focus - based on global megatrends - on the Energy Transition, Sustainable Transport, Digital Infrastructure and Essential Infrastructure sectors in Europe and North America. Clear ESG guidelines play a key role in our choice of investments.

Regular and reliable profit distributions and a stable dividend yield are important criteria when considering investments. This can be achieved by selecting companies for the portfolio that historically have strong account balances, that exist within a stable regulatory environment, that have long-term contracts and/or with which an inflation correlation can be obtained.

Another criterion is hedging against downside scenarios. We make this possible by investing in companies with limited competition, high market-entry barriers, contractually secured sales and strong contractual partners. The investment approach is also characterised by a long-term orientation and active asset management over the entire investment horizon.